As we all know every day there is a new revolution in technology. One of them is Tesla’s cobalt-free battery strategy by Elon Musk. Then What did he say in his cobalt-free battery Strategy?

In a tweet, Elon Musk responds by pointing out that using nickel would necessitate a cobalt-free battery. The battery works best when it is charged to 80%. In the long run, there will be a change, he continued, from nickel-based lithium to iron-based lithium, which is greatly favored. The Model 3 Standard Range utilized Tesla’s LPF battery design. He also gives Tesla’s Cobalt-free battery strategy and introduced new evolution in front of the world.

Then what is the strategy behind Tesla’s Cobalt-free battery? What are the benefits of Tesla’s cobalt-free battery? What is the policy of green power? Why does Tesla want to go for cobalt-free?

Here are the Top 10 Tesla’s cobalt-free battery strategies by Elon Musk

- Q1 Report

- Tweet by Elon Musk

- Benchmark Mineral Intelligence Data

- Iron Man- Elon Musk

- Reuterus Review

- Founder of US Battery

- Why LFP Cells?

- A Statement of Fisker

- Statement of CEO of Audi

- BMW Chief Procurement Officer

- Q1 Report.

Almost half of Tesla EVs produced in Q1 had no nickel, or cobalt in the battery.

The company is using LFP batteries in most of its standard-range vehicle products.

Model 3 Tesla with an LFP battery pack could still achieve a 267-mile range, due to its energy-efficient motors.

“Diversification of battery chemistries is critical for long-term capacity growth, to better optimize our products for their various use cases and expand our supplier base,” it said.

Tesla said earlier in April that total Q1 EV production rose 69.4% year on year to 305,407 units.

The EV maker plans to grow its manufacturing capacity as quickly as possible and said in the results that it is expected to achieve a 50% average annual growth in vehicle deliveries.

The rate of growth would depend on its equipment capacity, operational efficiency, and the capacity and stability of the supply chain.

- Tweet by Elon Musk.

The development of new batteries is of paramount significance to the whole EV car industry.

Panasonic’s most recent 4680 battery, intended for new Tesla cars, is a step in the right direction.

Not only does this mean that Elon Musk was right when he said that Tesla could do without cobalt in its batteries, but he also showed initiative to lead us all even deeper in the direction of the electric car revolution.

- Benchmark Mineral Intelligence Data

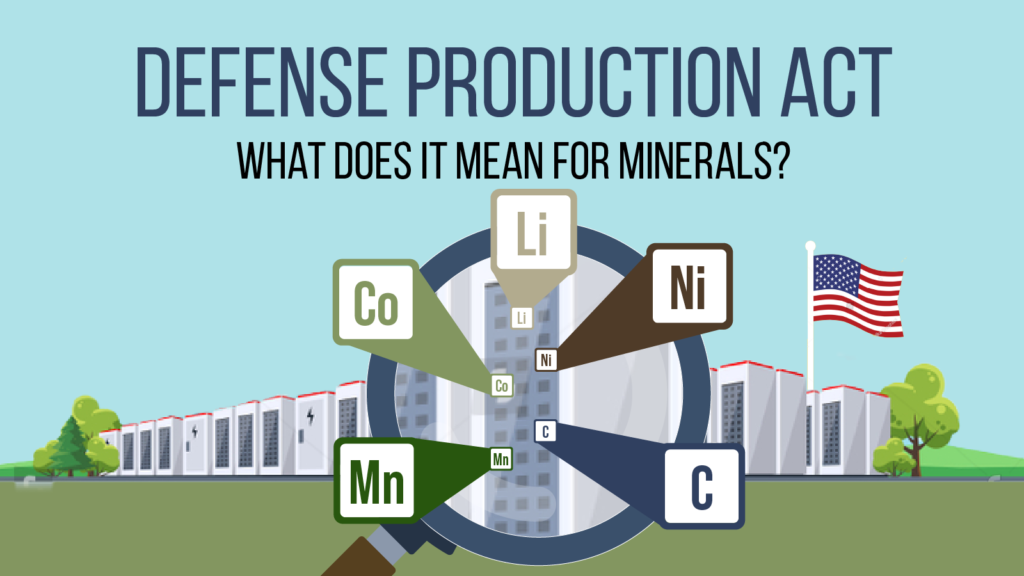

According to information from Benchmark Mineral Intelligence (BMI), only 3% of electric vehicle batteries in the United States and Canada and 6% in the European Union are iron-based. In China, however, LFP batteries command 44% of the EV market.

According to BMI, Tesla’s consistent improvement in its battery tech has resulted in a steady decline in the company’s usage of cobalt for its electric cars.

Since the days of the original Tesla Roadster and the first-generation Tesla Model S, the electric car maker has managed to reduce its cobalt consumption by an average of 59% per vehicle.

The Tesla Model S, for example, consumed 11 kg of cobalt per car, while the company’s newest offering, the Model 3, only consumes 4.5 kg of cobalt per vehicle.

- “Iron Man” – Elon Musk

Tesla currently uses LFP batteries in its base vehicles, though Elon Musk has hinted that the EV company will use more cobalt-free cells in more products.

Amusingly enough, by playing a notable part in LFP battery adoption, it appears that Elon Musk has effectively become an “iron man” of sorts.

- Reuters Review

According to a Reuters review of the EV market, Tesla is not alone in supporting LFP batteries.

Over a dozen companies are reportedly considering building LFP battery cell plants in the United States and Europe in the next three years.

- Founder of US Battery

Mujeeb Ijaz, the founder of US battery startup Our Next Energy, noted that LFP has a future in the EV industry.

“I think lithium iron phosphate has a new life. It has a clear and long-term advantage for the electric vehicle industry,” he said.

There was a reason why LFP batteries took this long to gain ground.

- Why LFP cells?

Due to the heavier, more significant, and high-energy holding capacity, LFP cells are preferred for making batteries.

In the below table, we mentioned the difference between LFP cells and NCM cells which states why LFP cells are better than NCM.

The table shows the difference between LFP and NCM cells

| Parameters | LFP Cells | NCM Cells |

|---|---|---|

| Components | Lithium, Iron, Phosphate | Nickel, Cobalt, Manganese |

| Strength of material | High | Low |

| Availability | More | Less |

| Charging capacity | Fully charged without degradation | Fully charged with some degradation |

| Energy | High energy holding capacity | Low energy holding capacity |

| VCTP Ratio | 60% | 40-45% |

| GCTP Ratio | 85-90% | 60-65% |

LFP cells use cheaper materials, and while they could be consistently charged fully without much degradation, they tend to be larger, heavier, and generally hold less energy than nickel-cobalt-manganese (NCM) cells.

Thus, electric cars that use LFP batteries tend to have a shorter range. Since the company is electively the undisputed leader in the electric vehicle sector, the roughly 150,000 cars it produced last quarter that was equipped with LFP batteries took several analysts and specialists by surprise.

And similar to other innovations from the company, such as its use of mega cases, other carmakers will soon be following suit.

- A Statement of Fisker.

EV startup Fisker, for one, noted that it is planning on using LFP batteries for its lower-range SUVs.

CEO Henrik Fisker pointed out that the company is in discussions with battery suppliers from the United States, Canada, and Mexico.

Fisker noted that LFP batteries are perfect for vehicles that are used by city dwellers.

“If I never leave Los Angeles, I never leave San Francisco, I never leave London … I think that’s where LFP comes in well,” he said.

- Statement of CEO of Audi.

Audi CEO Markus Duesmann, in comments that were shared last March, also spoke highly of LFP cells’ potential.

“It may well be that we will see LFP in a larger portion of the fleet in the medium term.

After the war, a new situation will emerge; we will adapt to that and choose battery technologies and specifications accordingly,” he said.

Even BMW, which is arguably lagging in the electric vehicle race considering the pace of rivals such as Volkswagen and Daimler, is looking towards LFP batteries.

- BMW Chief Procurement Officer

Recent comments from BMW chief procurement officer Joachim Post indicated that the German automaker was analyzing the merits of iron-based cells.

“We’re looking at different technologies to minimize the use of resources and also we’re looking at optimizing chemistry,” the executive said.

Why Elon Musk and Tesla have Quietly seen Success with Cobalt-free EV batteries?

Four years ago, Elon Musk said his Tesla vehicles were going to have cobalt-free batteries.

In the first quarter of this year, amid the huge uproar over Musk’s desired acquisition of the social platform Twitter, Tesla revealed that nearly half of its vehicles produced during that period featured cobalt-free lithium iron phosphate (LFP) batteries.

Simon Alvarez, in Teslarati, writes that LFP batteries are not new but represent little of the electric vehicle market in the United States, Canada, and the European Union.

In China, however, LFP batteries account for 44% of the market.

LFP batteries are a component of the electric vehicle market that is being sought after by several automakers as the demand for cobalt continues to rise – and therefore its price.

Benchmark Mineral Intelligence, as reported in TheStreet, expects more than 30% growth in cobalt demand due to new model launches and government legislation.

The cobalt Problem:

Reuters Review is also a component of the earth’s crust, like nickel, and is utilized in a variety of products besides electric batteries, such as airbags, varnishes, and paint drying agents. Despite being beneficial, cobalt mining has many risks.

Before being forced out of a disagreement by a lawsuit, China possessed one of the largest cobalt and copper mines in the world in the Republic of Congo as part of its effort to dominate the electric vehicle market.

According to the New York Times, on payments to the Congolese government.

The majority of the world’s cobalt is produced in the Republic of Congo, where children are used to mining the metal in hazardous conditions. Tunnel collapses have killed or injured numerous miners there.

This practice continues despite calls for reform from watchdog organizations and international pressure.

The state of the critical minerals’ supply chain:

It’s in trouble, to put it lightly. Insufficient mining is taking place to provide the resources required to not only support a clean energy economy but also to strengthen national security in the United States.

Even though U.S. President Joe Biden has set the goal for 50% of new car models produced to be electric by 2030, some automakers are cautioning it is an unlikely feat.

The Wall Street Journal recently reported RJ Scaringe, chief executive officer of EV manufacturer Rivian, as saying “90% to 95% of the (battery cell) supply chain does not exist.”

What does the Green Energy Policy say About Tesla’s Cobalt-free EV Batteries?

The politics of green power:

Biden invoked the Defense Production Act — a Cold War-era law — to support additional domestic mining to shore up supplies of critical minerals and rare earth elements. That happened this spring.

The problem is his administration is also tossing out Trump administration changes to the environmental review process if that extraction takes place on federal lands.

While the former president aimed to shorten that review process — which could drag on for years or even more than a decade — the Biden administration wants a return to the former, more thorough environmental reviews — which means long delays in mining projects.

Joe Lowry, a mining industry veteran also known as Mr. Lithium, made this observation: “You can build a battery factory in two years, but it takes up to a decade to bring on a lithium project,” as reported in Bloomberg.

Some congressional Democrats, too, are aiming at the nation’s mining law that has been on the books since 1872, seeking to institute reforms that include establishing royalty rates for the first time on mining on federal land and stricter environmental standards.

Those proposed reforms will be aired at a press conference.

Based on Adama’s intelligence data:

Based on Adamas Intelligence data, the momentum of Tesla’s LFP-equipped Model 3 only increased from that point.

Propelled further by deliveries to Europe, the LFP-battery China-made sedan comprised 46% of all Model 3 sales in January and a remarkable 32% of the battery capacity in all LFP-equipped cars globally.

This trend, Adamas’ data showed, boosted LFP’s overall share in the global battery market in terms of capacity to 18.5% in January 2021.

This was a remarkable milestone for LFP batteries, considering that it only commanded 1% at the beginning of last year and 3% by June 2020.

Adamas Intelligence’s Head of Data and Analytics Alla Kolesnikova noted that the momentum of LFP cells had been particularly felt in China.

In 2020, the adoption of cobalt-free batteries saw a resurgence in the market, with both veteran automakers and younger EV companies adopting the technology.

“LFP battery capacity deployed onto roads increased six-fold and we continue to see cathode manufacturers ramping up output and a growing list of the automakers in China announcing upcoming model versions that will incorporate LFP cells.

Among the more prominent are Xpeng, Series, and VW,” Kolesnikova said.

Roskill, one of the world’s first management consultancies and a key player in critical materials supply chain intelligence, has determined that LFP cathode and precursor material manufacturing capacity is currently up 10-fold in January-February 2021 compared to the same months in 2020.

A good part of this is the adoption of the batteries by notable EV players like Tesla and breakthroughs in the cobalt-free batteries themselves.

Tweet by Elon Musk.

Tesla is inching closer to reaching its Model 3 production goals. As the electric vehicle sector attempts to move from niche market status to mainstream acceptance, cobalt demand is surging since it’s the main component of electric car batteries.

At that time Elon Musk tweeted “We use less than 3% cobalt in our batteries & will use none in next-gen.“

Originally tweeted by Kori Hale (@korihale) on 12/06/2018.

What is the Strategy Behind Tesla’s Cobalt-Free Battery?

- Tesla targets cobalt-free batteries in a bid to minimize environmental impact.

- Bloomberg has forecast that the global demand for cobalt could increase more than 47-fold by 2030, driven by the EV revolution.

- 2019 impact report, states that while Tesla has implemented sustainable supply chain practices and has battery recycling capability at its Nevada Gigafactory, there is still room for improvement.

- Tesla is notably a member of the Responsible Mining Initiative (RMI), which provides businesses with a framework for identifying “red flags” on human rights and environmental issues in supply chains.

- As for the end-of-life stage, the report confirms that Tesla recycled the below components in 2019.

| Recycled Components | Weights |

|---|---|

| Nickel | 1,000 tonnes |

| Copper | 320 tonnes |

| Cobalt | 10 tonnes |

- Recent research from the University of Birmingham concluded that the development and industrialization of EV battery recycling technologies are currently being outpaced by EV uptake, paving the way for a “huge waste management problem” in decades to come.

Why does Tesla want to go Cobalt-free?

While Elon Musk announced significant changes to lithium-ion batteries more than three years ago, we are still to see the real-world adoption of the new cobalt-free batteries in electric cars.

Now, cobalt, as cen.acs.org reports, “is key for boosting energy density and battery life because it keeps the layered structure stable as lithium ions get reversibly stuffed into and extracted from the cathode during battery operation.”

Apart from Tesla, which works with the Chinese company Contemporary Amperex Technology Ltd. (CATL) to develop new-gen cobalt-free batteries, GM works intensely with Panasonic.

As you probably know, Panasonic supplies Tesla with batteries as well, but more about that a bit later.

Tesla’s intentions to turn to cobalt-free batteries are rooted in the fact that the mineral will be hard to come by shortly. After all, some researchers suggest that the material demand will increase tenfold by the 2030s.

Furthermore, Caspar Rawles, an analyst at Benchmark Mineral Intelligence told Theverge.com, that there is a “number of new projects to mine cobalt in the Democratic Republic of Congo (where they mine most of the Cobalt mineral anyway).

I think we’ll have stable prices until about 2022 when demand is going to exceed what new supplies can come, and then prices are likely to increase.”

And thus, Tesla wants to go cobalt-free.

Conclusion

Global demand for cobalt increasing day by day. To minimize environmental impact Elon Musk tweeted about the cobalt-free battery. Thus, we mentioned Top10 Tesla cobalt-free battery strategy by Elon Musk. We also stated why Elon Musk and Tesla saw success with cobalt-free batteries.

A green policy power that was introduced due to the cobalt-free batteries is maintaining the environment and future. And thus Elon Musk tweeted about the cobalt-free batteries.

FAQs

Why is Tesla Switching to LFP Batteries?

The information also gives us an interesting insight into Tesla’s mix of models, which is generally quite hazy.

Elon Musk, CEO of Tesla, has often stated that the company intends to switch more electric vehicles to LFP batteries to resolve nickel and cobalt supply issues during the past few years.

Are Cobalt-Free Batteries the Future of Electric Vehicles?

Batteries made of iron phosphate (LFP), which don’t contain nickel or cobalt, are typically less expensive and safer, but they have a lower energy density, which makes electric vehicles less effective and has a shorter range.

However, they have lately advanced to the point where it is sensible to utilize cobalt-free batteries in less expensive, shorter-range cars.

How Much Cobalt does an Electric Car Battery Use?

Cobalt is an essential part of the lithium-ion batteries that give electric vehicles the range and durability needed by consumers.

The majority of modern electric vehicles use these battery chemistries in lithium-nickel-manganese-cobalt-oxide (NMC) batteries which have a cathode containing 10-20% cobalt.

Will Elon Musk Drop Cobalt From His Batteries?

(Kitco News) – After trumpeting his vision of dropping cobalt from his batteries, First Cobalt (TSX-V: FCC; OTCQX: FTSSF) said Elon Musk will face a “formidable challenge” ditching the blue metal.

First Cobalt describes itself as a North American pure-play cobalt company with a dedicated refinery in Ontario, Canada.

What type of Battery Does Tesla Use?

Tesla currently uses LFP batteries in its base vehicles, though Elon Musk has hinted that the EV company will use more cobalt-free cells in more products.

Posts related to battery and electric cars.

- What would happen to my electric car lithium-ion battery if it was left completely discharged for a year?

- Tesla Battery Degradation In Cold Weather

- Tesla Model 3 SR+ LFP Battery Capacity Per Year

- Can electric car batteries explode within a year?-An ultimate guide 2024

- How Many Years Will Tesla Model 3 Battery Last?

- IRA Benefits: Top 6 EV Tax Credits to Consumers & U.S. Automakers- A complete guide 2024

- Tesla Model 3 Energy Saving Mode

- Do you own an electric car battery?

- Electric Car And Tesla Range Loss in Traffic Jam

- Range Of Electric Cars When Every System Is Turned On

- Top 10 Benefits of “Battery Passports” for Electric Cars- A complete guide 2024

- Tesla Battery Heater in Extreme Cold (Model S, Model X Model Y)-Complete Guide

- How Accurate Are Electric Car Ranges (Tesla, Nexon, Nissan, and Chevy)

- Do Electric Cars Have More Than One Battery

- Is 220 Miles Of Range Enough For Electric Car?